All Categories

Featured

Table of Contents

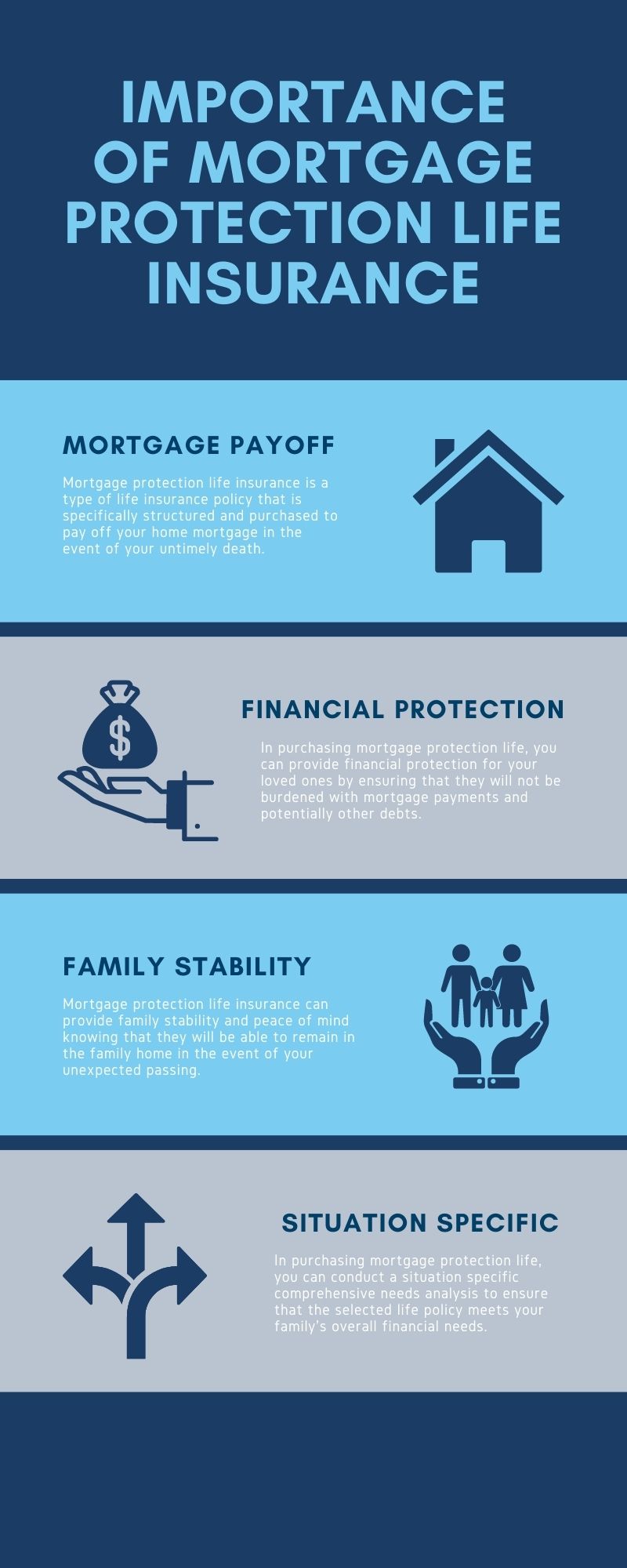

Right here's how the 2 contrast. The essential distinction: MPI coverage pays off the remaining equilibrium on your mortgage, whereas life insurance gives your recipients a fatality advantage that can be made use of for any kind of purpose (cigna mortgage protection insurance).

The majority of policies have an optimum limit on the size of the home loan equilibrium that can be guaranteed. This maximum quantity will certainly be clarified when you use for your Mortgage Life Insurance coverage, and will certainly be documented in your certification of insurance coverage. Also if your starting home mortgage balance is higher than the maximum limitation, you can still insure it up to that limit.

They likewise such as the truth that the proceeds of her home mortgage life insurance policy will certainly go straight to pay the mortgage balance as opposed to perhaps being made use of to pay other debts. life of a mortgage. It is very important to Anne-Sophie that her family members will be able to proceed living in their family members home, without monetary duress

However, keeping all of these acronyms and insurance kinds directly can be a migraine. The complying with table positions them side-by-side so you can promptly separate among them if you get confused. Another insurance policy protection kind that can repay your mortgage if you pass away is a basic life insurance policy.

Income Protection Mortgage Payment Insurance

A is in place for an established number of years, such as 10, 20 or 30 years, and pays your beneficiaries if you were to pass away throughout that term. A gives insurance coverage for your entire life span and pays out when you pass away.

One usual regulation of thumb is to intend for a life insurance plan that will certainly pay as much as 10 times the insurance holder's income amount. Additionally, you might choose to use something like the cent approach, which includes a household's debt, revenue, home loan and education and learning costs to compute how much life insurance policy is required.

It's additionally worth noting that there are age-related limitations and thresholds imposed by nearly all insurance companies, that usually won't give older buyers as several choices, will certainly charge them a lot more or may refute them outright. better protect life insurance.

What Is Mortgage Payment Insurance

Here's exactly how mortgage security insurance coverage measures up versus basic life insurance coverage. If you have the ability to certify for term life insurance policy, you must avoid home mortgage protection insurance coverage (MPI). Compared to MPI, life insurance policy offers your family members a less expensive and extra versatile benefit that you can depend on. It'll pay out the very same amount no matter when in the term a death happens, and the cash can be used to cover any costs your family regards needed during that time.

In those situations, MPI can provide terrific tranquility of mind. Simply make sure to comparison-shop and review all of the small print before authorizing up for any kind of plan. Every home mortgage defense choice will have numerous policies, guidelines, benefit choices and drawbacks that need to be weighed very carefully against your specific circumstance.

A life insurance coverage plan can aid pay off your home's home loan if you were to die. It's one of numerous means that life insurance may assist safeguard your loved ones and their monetary future. One of the very best ways to factor your mortgage right into your life insurance policy requirement is to talk with your insurance policy agent.

Instead of a one-size-fits-all life insurance policy plan, American Domesticity Insurance provider uses policies that can be developed especially to satisfy your family's requirements. Here are several of your choices: A term life insurance policy policy (mortgage protection health issues) is energetic for a certain amount of time and usually uses a larger quantity of insurance coverage at a reduced cost than a permanent policy

Instead than only covering a set number of years, it can cover you for your entire life. It also has living advantages, such as cash value buildup. * American Family Life Insurance policy Firm uses different life insurance coverage plans.

They may likewise be able to help you locate gaps in your life insurance policy coverage or new ways to conserve on your other insurance coverage policies. A life insurance beneficiary can pick to make use of the death benefit for anything - best mortgage protection insurance companies.

Loan Insurance

Life insurance policy is one means of aiding your family members in settling a home loan if you were to pass away prior to the home loan is entirely paid back. No. Life insurance policy is not necessary, yet it can be a crucial part of aiding see to it your enjoyed ones are monetarily safeguarded. Life insurance coverage profits might be utilized to help pay off a mortgage, but it is not the same as mortgage insurance policy that you could be required to have as a condition of a finance.

Life insurance policy might assist ensure your residence stays in your family members by offering a survivor benefit that might aid pay for a mortgage or make crucial acquisitions if you were to die. Get in touch with your American Family members Insurance agent to discuss which life insurance plan best fits your requirements. This is a brief description of coverage and is subject to plan and/or rider terms, which might differ by state.

Mortgage Life Insurance Protection Plan

Words lifetime, lifelong and permanent are subject to policy terms and problems. * Any kind of loans extracted from your life insurance plan will accumulate rate of interest. Any type of exceptional loan balance (financing plus passion) will be subtracted from the survivor benefit at the time of claim or from the cash worth at the time of surrender.

** Topic to plan conditions. ***Discount rates might differ by state and company financing the car or house owners plan. Discount rates might not use to all insurance coverages on a car or property owners plan. Price cuts do not relate to the life plan. Plan Types: ICC18-33 (10 ), ICC18-33 (15 ), ICC18-34 (20 ), ICC18-35 (30 ), L-33 (10 )(ND), L-33 (15 )(ND), L-34 (20 )(ND), L-35 (30 )(ND), L-33 (10 )(SD), L-33 (15 )(SD), L-34 (20 )(SD), L-35 (30 )(SD), ICC18-36 (10 ), ICC18-36 (15 ), ICC18-36 (20 ), ICC18-36 (30 ), L-36 (10 )(ND), L-36 (15 )(ND), L-36 (20 )(ND), L-36 (30 )(ND), L-36 (10 )(SD), L-36 (15 )(SD), L-36 (20 )(SD), L-36 (30 )(SD), ICC17-225 WL, L-225 (ND) WL, L-225 WL, ICC17-227 WL, L-227 (ND) WL, L-227 WL, ICC17-223 WL, L-223 (ND) WL, L-223 WL, ICC17-224 WL, L-224 (ND) WL, L-224 WL, ICC17-228 WL, L-228 (ND) WL, L-228 WL, ICC21, L141, MS 01 22, L141, ND 02 22, L141, SD 02 22.

Home mortgage security insurance policy (MPI) is a different kind of protect that could be practical if you're unable to repay your home loan. While that extra protection appears excellent, MPI isn't for everybody. Here's when mortgage defense insurance deserves it. Mortgage protection insurance policy is an insurance plan that pays off the rest of your home loan if you die or if you end up being impaired and can't work.

Like PMI, MIP secures the lending institution, not you. Unlike PMI, you'll pay MIP for the period of the financing term. Both PMI and MIP are called for insurance coverage coverages. An MPI policy is entirely optional. The quantity you'll pay for home loan security insurance policy relies on a selection of aspects, consisting of the insurer and the existing equilibrium of your mortgage.

Still, there are advantages and disadvantages: Many MPI plans are issued on a "guaranteed acceptance" basis. That can be advantageous if you have a health condition and pay high rates forever insurance coverage or struggle to obtain coverage. An MPI plan can give you and your household with a sense of safety and security.

Cibc Mortgage Life Insurance

You can select whether you require home mortgage security insurance coverage and for just how lengthy you require it. You could want your home mortgage defense insurance coverage term to be close in size to how long you have left to pay off your home mortgage You can cancel a home mortgage security insurance coverage plan.

Latest Posts

Funeral Insurance Companies

Funeral Cover Premiums

Final Expense Insurance For Seniors